According to data from the China Rubber Industry Association, the total production of automobile tires in 2014 was 562 million, an increase of 6.2% year-on-year. Among them, the radial tire output was 511 million, an increase of 7.3%, and the radialization rate was 90%; the output of bias tires was 0.51 million, a decrease of 3.7%. In the radial tires, the output of all-steel tires was 112 million, an increase of 4.6%; the output of semi-steel tires was 399 million, an increase of 8.1%. In terms of proportion, semi-steel tires accounted for 71% of the total output, all-steel tires accounted for 20%, and biased tires only accounted for 9%.

Semi-steel tires are mainly used on cars. The tires are small in size and weigh 7-10 kilograms per article. All steel tires are mainly used on trucks and buses, especially heavy trucks . The tyres are larger in size and have a wider tread width. Above 8.25 inches, single tire weights range from 50 to 70 kg/bar.

In addition, in the tire formulation, the composition ratio of natural rubber and synthetic rubber in all-steel tires and semi-steel tires differs significantly. Semi-Steel Tire Natural rubber and synthetic rubber use the same proportion, the proportion of weight in the 1/4 up and down, and all steel tires are mainly natural rubber, natural rubber accounted for about 40%, the use of synthetic rubber ratio is more than 10 %the following.

Judging from the consumption of rubber, the all-steel tire industry is the main force for natural rubber consumption. According to the preliminary estimate of the 2014 production data, the production of 112 million all-steel tires, natural rubber consumption of 2,755,200 tons, accounting for more than 60% of the total consumption of natural rubber in China, for the semi-steel tire production of natural rubber consumption of 3 Times.

Tire consumption is mainly divided into two parts, one is domestic consumption, and the other is export market. National Bureau of Statistics data show that in 2014 China's tire production was 1.079 billion (statistical caliber and the China Rubber Industry Association data exist some differences). Customs data shows that in 2014, China exported 476 million tires. Based on the above data, China's exports of tires account for about 40% of the total domestic tire production. In recent years, the global economic growth has slowed down, foreign trade frictions have continued, and the tire export situation has been grim. Since the beginning of 2015, the slowdown in tire exports has been evident. However, we also see that tire consumption is still concentrated in the country. Therefore, in addition to monitoring tire export conditions, it is also necessary to monitor the domestic tire consumption, especially the operation of the all-steel tire market. In general, all steel tires are mainly used on heavy trucks.

Heavy truck market plays a decisive role

After years of development, China's auto industry has formed a considerable amount of market capacity. The data shows that in 2014, the national automobile production and sales were 23.72 million and 23.49 million, respectively, an increase of 7.3% and 6.9% year-on-year. Among them, the production and sales of passenger cars were respectively 19.2 million and 19.7 million, an increase of 10.2% and 9.9% year-on-year; commercial vehicle production and sales were 3.8 million and 3.79 million, respectively, down 5.7% and 6.5% year-on-year.

In terms of market availability, as of the end of 2014, the number of motor vehicles in China reached 264 million, of which 154 million were vehicles. Therefore, the domestic tire consumption market can basically be divided into two major segments, namely the matching market with new car sales and the maintenance-replacement market with retail sales.

Let's look at the situation of the new car market. According to the statistical classification standards of 2005 models, China's automobiles are classified into two categories: passenger vehicles and commercial vehicles. Commercial vehicles include passenger cars, passenger vehicles, non-integrated vehicles, trucks, semi-trailer tractors, and non-integrated trucks. According to the classification standards of the China Association of Automobile Manufacturers, trucks are divided into four categories: heavy, medium, light and micro. Among them, the total mass of more than 14 tons is a heavy-duty truck (common weighing card). According to statistics, the total sales volume of commercial vehicles, including goods vehicles and passenger cars, was 3.791 million in 2014, of which 744,000 were heavy truck sales.

We roughly estimate the consumption of natural rubber with the corresponding supporting factors, single tire weight and plastic consumption ratio. It can be seen that the total consumption of natural rubber in the supporting market tire consumption is about 619,200 tons, of which the consumption of heavy trucks is as high as 21,960,000 tons, accounting for new vehicles. More than 35% of the total rubber consumption of the market is equivalent to the amount of natural rubber consumed by the entire passenger car market.

Look at the maintenance stock market again. According to the Ministry of Public Security, as of June 2014, the number of vehicles in China was 147 million, of which 115 million were passenger cars, 0.21 million were goods vehicles, and 535.56 million were heavy trucks.

According to a rough estimate of the replacement coefficient of different types of vehicles and their corresponding tire weight and consumption, the replacement demand of 136 million passengers and trucks will consume approximately 2.506 million tons of natural rubber, of which 1.95 million tons will be consumed by heavy trucks. It accounts for more than 60% of the total amount of glue consumed in the replacement market.

Comprehensive support and retail two markets, heavy trucks will no doubt occupy absolute position in natural rubber consumption. On the one hand, there are more tires for heavy trucks and the number of new tires is more than 12 on average. On the other hand, heavy trucks have higher operating loads, higher frequency of use, higher wear and tear, and demand for replacement is strong. In general, all vehicles must be replaced during 8 to 16 months. Once tire. Therefore, the production, sales, and operation of heavy trucks play a crucial role in natural rubber consumption. Comparing the two markets of new car support and maintenance, the maintenance stock market occupies an absolute position in natural rubber consumption. With the continuous expansion of the stock market, the proportion of new car market has shrunk year by year, but the production and sales of new cars basically reflect the consumption of tires. It is still an important monitoring indicator for tires and natural rubber consumption.

Heavy truck production and sales are bleak

From the specific use of truck models, micro-cards are generally used in urban and rural individual passenger and cargo markets; light-duty trucks are mainly based on short-haul light loads in the city; medium-sized trucks are used as traditional inter-city transport or conversion vehicles; heavy trucks are used in many cases. Long-distance large tonnage logistics transportation or supporting construction machinery construction.

According to the statistics of China Association of Automobile Manufacturers, in May 2015, the domestic truck market produced and sold 239,724 vehicles and 244,260 vehicles. The production decreased by 12.99% month-on-month and 13.35% year-on-year. The sales decreased by 11.93%, 10.29% year-on-year, and decreased by -19.80% in April. Based on the continued narrowing. Among them, heavy truck production and sales of 49044 and 51712 vehicles, respectively, fell by 6.90% and 11.92%, a decrease of 35.32% and 30.16% respectively.

Although the decline in heavy truck production and sales narrowed from 39.13% and 33.31% in April, it was still the worst monthly segment of the truck market. At this point, the heavy truck market has fallen by more than 30% for four consecutive months. Heavy truck market, "deep and fiery" degree is evident.

According to the product's completeness and application, heavy trucks are divided into heavy-duty trucks, heavy-duty trucks (heavy truck chassis) and semi-trailer tractors. Among them, the heavy-duty chassis is the basis of the entire vehicle, and it is mainly used in the construction machinery and related areas, and has a high degree of correlation with infrastructure and real estate construction. Semi-trailer tractors are mainly used for logistics transportation, including port cargo and bulk cargo road freight transportation, and some are used for refitting the market. With the promotion of weight-based toll collection and the improvement of logistics and transportation efficiency, the market demand for semi-trailer tractors continues to increase, and the market share gradually expands.

According to the breakdown data of heavy trucks, 24,294 tractors were sold in semi-trailer in May, down 1.75% year-on-year, accounting for 46.98% of the total sales of heavy trucks; 12,520 units of heavy trucks sold, down 39.26% year-on-year, accounting for sales of heavy trucks. The proportion of the total amount was 24.21%; 14898 units of non-complete vehicles were sold, down 47.87% year-on-year, accounting for 28.81% of the total sales of heavy trucks. The proportion of sales of non-integrated vehicles, which have a large correlation with real estate and infrastructure, was the largest year-on-year drop, which was over 40%. The semi-trailer trucks related to logistics and transport have slightly better sales.

On the whole, the fundamental improvement in the consumption of heavy trucks remains to be stabilized in the economy, especially the effective pull of real estate and infrastructure investment.

According to the heavy truck production and sales data, we can see that the seasonal characteristics of its market operations are obvious. Monthly sales of heavy trucks (including chassis and semi-trailer tractors) can be seen from November to February of the following year due to the inability of the winter construction industry in the north to start, and the related demand for material transportation and engineering construction has been reduced to some extent. Heavy-duty truck sales are in seasonal off season. After the Spring Festival, the demand for building construction was released collectively in March and April, which led to a jump in the sales volume of heavy trucks, and slowly declined with the gradual satisfaction of the demand. In the hot summer months of July and August, downstream demand once again fell to the low point of the year. However, judging from the production and sales data of the first five months of this year, the heavy-duty truck market showed a clear peak season, and in the second half of the year, especially in July and August, it will enter the off-season production and sales, and the ring demand will face a sharp decline.

Heavy truck demand related industry development differentiation

Downstream of heavy trucks involves multiple industries.

The first is the logistics and transportation industry. Heavy trucks based on semi-trailer tractors are used in logistics transportation. The increase in freight volume reflects downstream logistics demand for heavy trucks.

Historically, the increase or decrease in freight volume has been consistent with the sales volume of heavy-duty trucks, especially the increase or decrease in the sales of tractor-trailers. Since 2014, the growth rate of China's road freight and turnover volume has slowed down significantly, which has directly led to shrinking demand for heavy truck logistics transportation.

The second is real estate. Heavy trucks and non-integrated vehicles are mainly used in the relevant aspects of construction machinery, and have a high degree of correlation with real estate construction. The vigorous development of the real estate market has promoted the rapid growth of demand for heavy trucks. From the monitoring data of land acquisition and real estate new construction area, both have shrunk dramatically in the past two years, which has directly caused a sharp decline in the demand for non-integrated vehicles for heavy trucks. According to statistics, in May 2015, the cumulative new construction area of ​​commercial housing in China was 35.091 million square meters, a year-on-year decrease of 17.6%. The third is the infrastructure industry. The large-scale investment in the construction of fixed assets in the society has generated a large amount of civil transportation and road freight demand, which has brought a lot of product demand to the heavy-duty truck industry. The large scale of investment in fixed assets is one of the important driving forces for the continuous and rapid growth of heavy truck production and sales. Since the second half of 2014, the amount of investment in infrastructure construction has dropped significantly year-on-year, which has constrained the growth in the demand for heavy trucks.

The long-term slowdown in the heavy truck industry remains unchanged

Compared with the tragic production and sales in the first half of the year, the light of heavy truck market emerged in the second half of 2015. The main positive factors affecting the heavy truck market in the later stages are:

First, under the pressure of steady growth, infrastructure projects are being reviewed and approved. In the first half of 2015, the National Development and Reform Commission approved a large number of infrastructure projects such as railways, highways, and urban rail transit to provide certain guarantees for infrastructure investment and downstream heavy truck demand in the second half of the year.

In addition, another major benefit of infrastructure construction is the implementation of the “One Belt and One Road†policy. After the establishment of the AIIB, the relevant infrastructure projects represented by the “China-Thailand Railway†in the second half of 2015 will enter the substantive implementation stage.

Second, the amount of investment in real estate development has slowly risen. In the first half of 2015, the real estate market underwent a combination of adequate liquidity and unprecedented policy stimulus. It experienced a turnaround from a global downturn to a significant rebound in sales and a rebound in local prices. With the recovery of the sales of the property market and the acceleration of destocking, the first- and second-tier urban development enterprises in the second half of the year will increase the intensity of replenishment of stocks, which in turn will stimulate the recovery of the land market and stimulate the recovery of investment in development.

Third, the construction of major cities such as the establishment of the Free Trade Zone and the integration of Beijing, Tianjin and Hebei. The Shanghai Free Trade Zone has made positive progress in its operation for more than a year. The construction of the second batch of free trade zones such as Guangdong, Tianjin, and Fujian has been accelerating. No expansion has been made since the trade zone, and the focus has been placed on the realization of the "Belt and Road Initiative." Hub cities with influence and radiation.

The completion of the free trade zone stimulates the development of foreign trade and logistics industries in these areas, which in turn will benefit the heavy truck industry, especially the tractor industry. At the same time, during the construction of key urban agglomerations integrating Beijing, Tianjin and Hebei, the construction of hardware facilities including road networks will provide rigid demand support for heavy trucks.

In addition, the elimination of yellow-standard vehicles and the replacement of yellow-standard vehicles, standardization of the geometric volume standard of concrete mixers, and the implementation of the first-tier cities in China V are the opportunities for the development of the heavy-duty truck market in the second half of the year, which will have a positive impact on the production and sales of heavy trucks. .

However, the domestic and international macroeconomic environment remains sluggish. The prospects for the recovery of the real estate industry are unpredictable. The unfavorable factors such as the decline in domestic coal production and weak transportation demand have also plagued the heavy truck industry. It is also difficult to restore the rapid growth of the previous period.

Based on the above analysis, the impact of heavy truck production and sales on natural rubber consumption is of utmost importance. In the first half of 2015, the heavy truck production and sales trend directly weakened the demand for natural rubber. In the second half of the year, driven by the increase in infrastructure investment and real estate recovery, heavy truck production and sales are expected to pick up. However, the long-term slowdown in the heavy-duty truck market has not changed, and it will continue to constrain the price of natural rubber.

Buy truck parts, on the Taobao stalls, multiple discounts waiting for you to take!Http://NewDrain.html

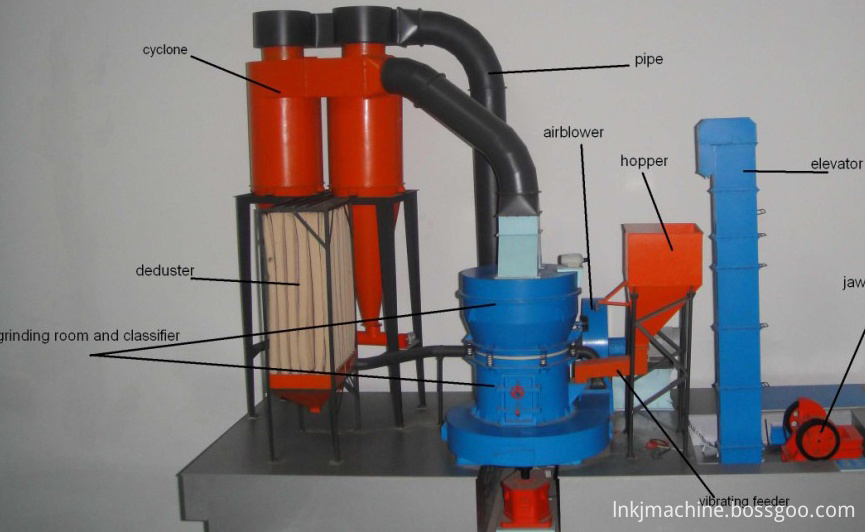

Working Principle

The grinding Process of the Main Mill is that the transmission device brings along the Central Shaft to drive. The upper part of the shaft connects with the Quincunx Rack, on the frame is loaded with the roller assembly, and forms a swinging pivot. The central shaft does revolve around the central rotation, at the same time it revolves around the grinding rings, and it self also rotates on account of the grinding effect. The shovel system, in the lower part of rollers, is loaded on the lower part of the Quincunx Rack. In the process of rotating of the shovel and the roller, the material will be fed gasket layer between the rollers and ring. The outside centrifugal force (compression force) yielding in this process will process the material into small powder, thus the desired powder is obtained.

Carbon Black Refinery Machine,Black Oil Refinery Machine,Base Oil Refinery Machinery,Waste Engine Oil Refinery Machine

Henan Lanning Technology Co., Ltd , https://www.lanningrecycling.com